After A Fire Insurance Shouldn't Be A Worry

1/6/2020 (Permalink)

SERVPRO of East Bradenton / Lakewood Ranch, we are here to help with fire damage and the secondary smoke and water damage 941-747-2333

SERVPRO of East Bradenton / Lakewood Ranch, we are here to help with fire damage and the secondary smoke and water damage 941-747-2333

Four of every five fire deaths and three quarters of all reported fire injuries in the US were caused by home structure fires, according to the National Fire Protection Association. NFPA Fires are known to spread quickly and cause a lot of damage.

Restoring your home to its original state can be costly. You don’t have to meet all the expenses on your own, because homeowners insurance covers fire damage. It's always good to understand the process, but know we will be there to help and we will work with your insurance company.

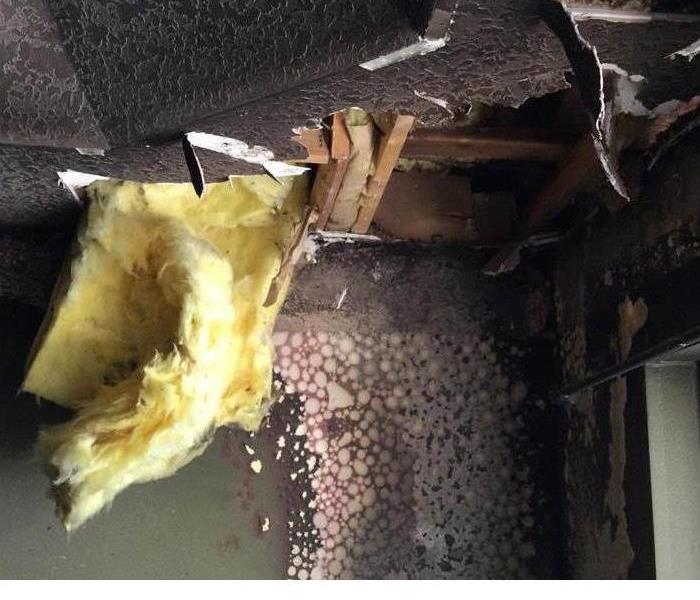

During a fire, there can be a lot of damage to your property and personal possessions. The damage results not only from the fire, but also from the smoke and the actions by the fire fighters. This is called secondary damage. Secondary damage can lead to mold growth, rusting or metals and permanent staining of plastics and PVC materials.

What Does Fire Damage Insurance Cover?

These policies are varied, and cover anything ranging from totally razed down structures and personal items.

Generally, the policies cover:

• The cost of total loss to your home.

• Cost of repairs to your damaged structure and the interior of the house.

• Covering of lost personal possessions.

• The cost of temporary housing as you wait for the house to be repaired.

• Costs of secondary damage to your property due to smoke and water damage.

In order to be compensated, you need to file a fire damage insurance claim. Remember we can take care of this for you.

Filing a Claim for Damages

Filing for damages can be complicated. This is because the insurance company will try to give you a minimum payout that might not be enough for the damages incurred.

Here are tips to make sure you get what you deserve:

Document the Damages

List all the damages that you have incurred both structural and personal. Make sure you take photos of the damages, the date it occurred, type of loss and a written report if possible. Document any injuries and make sure you get the police report. When taking photos, it is best to include a general photo as well as close-up photos of specific damages.

Keep Receipts and Bills

The insurance company needs evidence to understand what to pay. If you have performed any minor repairs, keep the receipts so that the insurance company understands the original damages.

Keep the Evidence Intact

The adjustor uses the site of the accident to determine your compensation. So, don’t throw away any damaged items before the insurance adjustor has been at the site.

We work with your insurance.

For a stress free claims process, SERVPRO can help manage the insurance paperwork and process.

At SERVPRO of East Bradenton / Lakewood Ranch, we are here to help with fire damage and the secondary smoke and water damage. Give us a call if you live in Bradenton, or Lakewood Ranch, 941-747-2333.

24/7 Emergency Service

24/7 Emergency Service